ETF Leverage Simulator

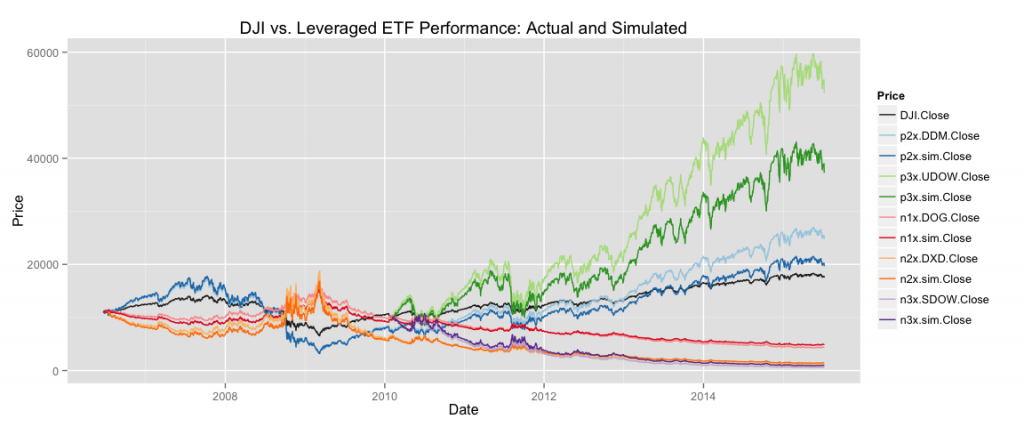

The ETF Leverage Simulator synthesizes long-term leveraged ETF returns.

Leveraged ETF’s are exchanged traded funds that use derivatives and debt to magnify the returns of an underlying index. Such funds apply a leverage multiplier (typical 2x or 3x) to amplify an index’s actual returns on a daily basis.

This application allows the user to select an underlying index and then run a simulation to see how an ETF (applying daily leverage to the underlying index) would have performed over the same period.

For more details, see the application ETF Leverage Simulator (shiny.io), implementation ETF Leverage Simulator (github) or detailed analysis Long Term Leveraged ETF Performance.